Monetary policy plays a critical role in managing Australia’s economy, particularly through the actions of the Reserve Bank of Australia (RBA). For students studying Year 12 Economics—whether through VCE, HSC, WACE, QCE, or other curriculums—understanding how the RBA implements monetary policy is not only assessable content, but essential for interpreting current events and preparing strong written responses.

This blog explains the evolution of the RBA’s monetary policy implementation system across three key phases: prior to the COVID-19 recession, during the pandemic, and under the 2024 reforms. It also highlights how these changes appear in diagrams and real-world case studies often used in exams.

The Corridor System Before COVID-19

Prior to the COVID-19 recession, the RBA used a framework known as a “corridor system” under a ‘scarce reserves’ approach. The RBA announced a target for the overnight cash rate—the interest rate banks charge each other for short-term loans—and used daily open market operations (OMOs) to keep the actual rate as close as possible to the target.

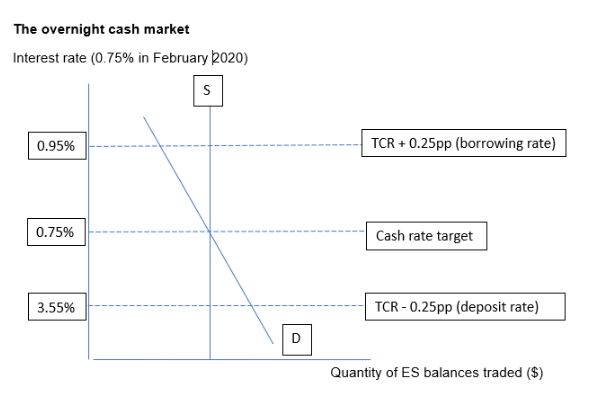

Graph depicting the overnight cash market under the ‘scarce reserves’ system

These OMOs were conducted through repurchase agreements (repos), where the RBA would lend money to banks at 25 basis points above the target cash rate. At the same time, any surplus funds held by banks in Exchange Settlement (ES) accounts earned interest at 25 basis points below the target. This created a tight corridor that strongly encouraged banks to trade in the overnight cash market within that range.

This system worked effectively under normal conditions, with the RBA actively managing liquidity and limiting reserves in the system to maintain monetary control. Students should understand this as the foundation of how OMOs were traditionally used to align the actual cash rate with the policy target.

The Shift to Excess Reserves During COVID-19

The COVID-19 recession disrupted the economic landscape and required the RBA to adopt more accommodative measures. In response, it transitioned to an ‘excess reserves’ system and introduced several unconventional monetary policy tools, including:

- The Term Funding Facility (TFF), which provided banks with low-cost funding

- Government bond purchase programs that injected further liquidity into the banking system

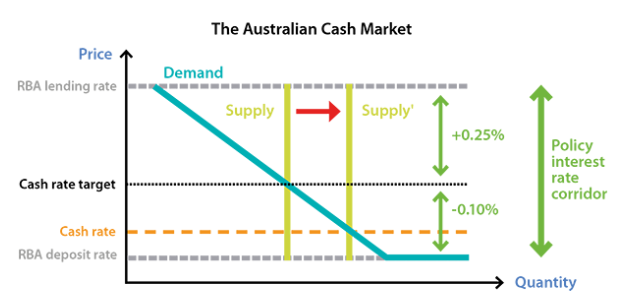

These measures greatly increased the supply of ES balances. In this context, the RBA widened the interest rate corridor by lowering the deposit rate (paid on ES balances) from 25 basis points below the target to just 10. It also significantly reduced the use of OMOs, allowing the cash rate to drift below the target rate.

Graph depicting the overnight cash market under the ‘excess reserves’ system

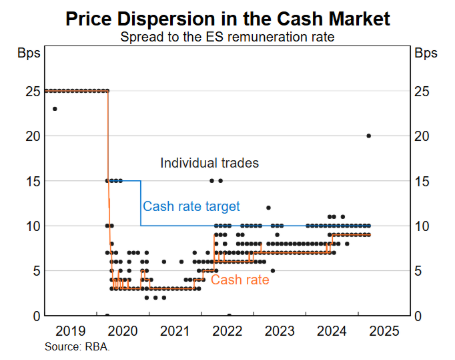

Graph depicting the cash rate below the cash rate target from March 2020

With excess liquidity in the system and limited market operations, short-term interest rates no longer aligned as closely with the RBA’s policy rate.

As shown above, the actual cash rate consistently sat below the RBA's target, highlighting the greater price dispersion and reduced precision of control during this phase. Students studying Economics should understand that while the RBA still influenced short-term interest rates through its deposit rate, it used liquidity injections rather than traditional OMOs.

2024 Reforms: Ample Reserves with Full Allotment

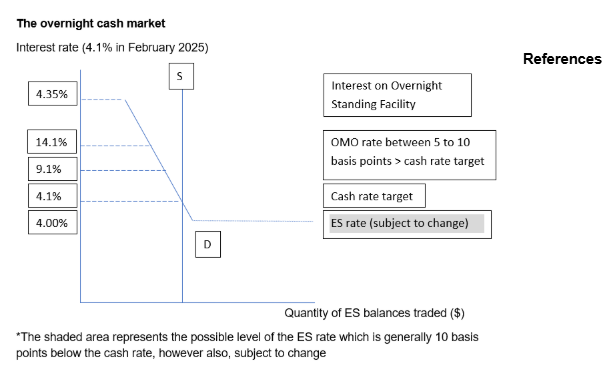

Recognising the need for a more adaptable system, the RBA implemented a new framework on 9 April 2025 known as the ‘ample reserves with full allotment’ system. This model accommodates the larger volume of ES balances while strengthening monetary control.

Key features include:

- The cash rate is allowed to float between 5 and 10 basis points above the target.

- Weekly OMOs continue, with the RBA now offering both 7-day and 28-day repo terms.

- Full allotment means the RBA supplies as much liquidity as banks demand, rather than setting strict limits.

This approach ensures that the cash rate remains near the target without daily intervention, reducing operational burden and risk to the RBA’s balance sheet. The 7-day repo option also improves flexibility for market participants managing short-term funding.

How the RBA Responds to Excessive Reserves

Under the ample reserves system, the RBA can make small adjustments to the ES rate (interest paid on ES account balances) if it perceives reserve levels to be excessively high. These changes help incentivise banks to lend in the private market rather than simply holding funds with the RBA.

Importantly, these decisions can be made independently of the Monetary Policy Board and allow the RBA to fine-tune conditions in the cash market while supporting its overall monetary policy goals.

Graph depicting the overnight cash market under the ‘ample reserves with full allotment’ system

Why This Matters for Year 12 Economics Students

Understanding how the RBA implements monetary policy is critical for students across Australian senior Economics curriculums:

- VCE Economics: Students must explain monetary policy tools, cash market mechanisms, and the role of OMOs.

- HSC Economics: The syllabus covers the transmission mechanisms of monetary policy and its impact on inflation and employment.

- QCE Economics: Students explore economic objectives and how monetary policy helps achieve them.

- WACE Economics: Students analyse the transmission of interest rate changes through the economy.

- IB Economics: Covers central bank functions and interest rate changes in global contexts.

In all cases, diagrams like the cash market and real-world data from the RBA are common components of assessments. Having a strong grasp of how the system has changed over time allows students to write high-quality, context-rich responses.

Final Thoughts

From traditional OMOs to excess reserves and now the ample reserves model, the evolution of the RBA’s monetary policy implementation reflects broader economic trends and the need for flexibility. As students of Economics, understanding not only how monetary policy works, but how it has adapted to changing circumstances, is key to academic success.

If you're preparing for your Year 12 Economics assessments and want help mastering monetary policy diagrams, terminology, or analytical responses, consider engaging an expert Economics tutor on Learnmate.

Alternatively, if you found this blog helpful, I’d personally love to support you as your tutor this year. You can view my profile on Learnmate and contact me to discuss tutoring options.

References

-

Salla, R. (2024). Economic Fundamentals in Australia (9th ed.)