When we talk about economic levers, there’s one in particular that the Reserve Bank of Australia (RBA) keeps a firm grip on: the official cash rate. But before we dive into interest rates, it’s worth understanding who the RBA is and what it actually does.

The Reserve Bank of Australia is the nation’s central bank. Its job is to help keep our economy running smoothly. That means managing inflation, promoting stable employment, and supporting economic growth. One of the main ways it does this is by adjusting the cash rate - a key interest rate that influences how much it costs to borrow or save money across the country.

You’ve probably heard the RBA mentioned on the news during interest rate announcements, but its decisions go far beyond headlines. They affect everything from mortgage repayments to grocery bills and job opportunities. So whether you're studying Economics in Year 12—through HSC, VCE, QCE, WACE, SACE, or IB—the Reserve Bank of Australia and its monetary policy decisions are core curriculum topics. This blog unpacks how interest rates are set, why they change, and how this connects to key learning outcomes across Australia's senior economics courses.

What is the Cash Rate, and Why Should We Care?

The cash rate is the interest rate on overnight loans between banks. While that sounds like it only affects big institutions, it actually influences the entire economy. Banks use it as a benchmark to set interest rates for loans, credit cards, and savings accounts. In short: when the RBA changes the cash rate, it creates ripple effects that affect your wallet, your job prospects, and the broader economy.

The RBA adjusts the cash rate to maintain a balance between economic growth, inflation, and employment. These changes are part of the RBA’s broader mandate: to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of Australians.

As Dr Philip Lowe, former Governor of the RBA, once said:

“Our goal is to make monetary policy work for the wellbeing of all Australians - whether you're a business owner, a worker, or a student just trying to get through your degree.”

- Dr Philip Lowe

The “Why” Behind Interest Rate Changes

Here’s a simple way to understand it:

- When inflation is too high, the RBA tends to raise interest rates to cool spending and borrowing.

- When economic growth is too slow or negative, the RBA may lower interest rates to stimulate borrowing, investment, and spending.

This push and pull is part of a broader strategy called monetary policy - a major piece of Australia’s macroeconomic puzzle.

In the words of RBA Deputy Governor Michele Bullock:

“We don’t raise or lower rates just for the sake of it—it’s always about what’s best for the economy, and ultimately, for everyday Australians.”

- Michele Bullock

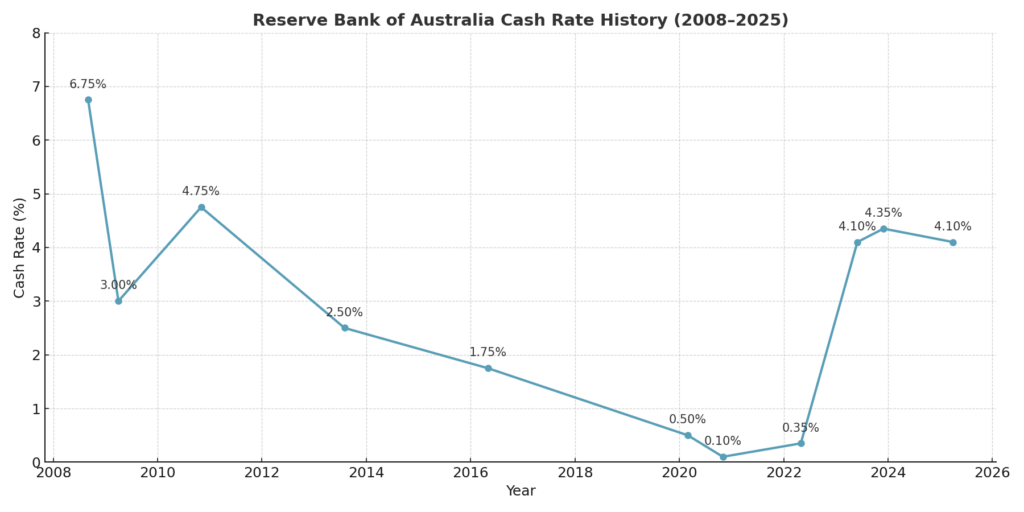

A Timeline of RBA Cash Rate Decisions (2008–2025)

Here’s a breakdown of some key moments that have shaped the economic landscape in Australia since 2008:

| Date | Cash Rate | Explanation |

|---|---|---|

| September 2008 | 7.00% → 6.75% | The Global Financial Crisis (GFC) began to ripple through global markets. The RBA responded quickly by cutting the cash rate to prevent a sharp slowdown. |

| April 2009 | 3.00% | Rates were slashed aggressively as the full impact of the GFC hit. The aim was to keep businesses afloat and Australians in jobs. |

| November 2010 | 4.75% | Australia was recovering steadily. The RBA cautiously raised rates to manage growth and prevent overheating. |

| August 2013 | 2.50% | With the mining boom cooling off and global growth slowing, the RBA eased the cash rate again to stimulate domestic demand. |

| May 2016 | 1.75% | Inflation remained below target, prompting another cut to support consumer spending and business activity. |

| March 2020 | 0.50% | COVID-19 struck. The RBA made rapid and sharp rate cuts to buffer the economy from the worst impacts of lockdowns. |

| November 2020 | 0.10% | The lowest cash rate in Australia’s history. The aim was to support a strong economic recovery post-COVID. |

| May 2022 | 0.35% | Inflation began to spike due to supply chain issues and global disruptions. The RBA responded with its first rate hike in over a decade. |

| June 2023 | 4.10% | After a series of increases, the rate hit a peak as the RBA worked to contain inflation while balancing economic momentum. |

| December 2023 | 4.35% | Despite signs of cooling inflation, the RBA implemented one final hike to keep price pressures under control. |

| April 2025 | 4.10% | With inflation nearing the RBA’s 2–3% target range, a small rate cut was introduced to support moderate growth. |

Visualising the Journey

RBA’s cash rate history from 2008 to 2025:

Where This Fits In Year 12 Economics

Understanding the role of the RBA and the cash rate is a key requirement in most Year 12 Economics curriculums in Australia:

- HSC Economics (NSW): You’ll study monetary policy and use real RBA data to evaluate economic performance.

- VCE Economics (Victoria): You’ll explore how interest rate changes influence the business cycle and transmission mechanisms.

- QCE Economics (Queensland): Topics include the RBA’s role in achieving economic objectives like growth, stability, and full employment.

- WACE, SACE & BSSS Economics: These programs similarly cover inflation targeting, the RBA's mandate, and how cash rate shifts impact aggregate demand.

- IB Economics: Students explore central banks globally and their use of interest rate policy.

If you’re preparing for your exams, RBA decisions and their justifications are often used in multiple-choice, short-answer, and extended responses. Knowing how to apply this knowledge to real-world examples like the GFC or COVID-19 gives you a critical edge.

Why This Matters to You

Even if you're a student with no mortgage or major debt, interest rate changes affect you more than you might think:

- HECS/HELP repayments are indexed to inflation, which is closely tied to interest rate policy.

- Job opportunities—especially in industries like construction, retail, tourism, and even finance—can rise or fall based on how the economy is performing under changing rates.

- The cost of living shifts as well. Higher interest rates typically reduce inflation over time, but they also increase borrowing costs for businesses and households.

And if you're studying Year 12 Economics, understanding how the Reserve Bank sets the cash rate and influences inflation, employment, and economic growth is critical for success.

- In HSC Economics (NSW), monetary policy is a major component, and you’ll need to analyse RBA decisions using current data.

- In VCE Economics (Victoria), you’ll explore the transmission mechanisms of interest rate changes and their macroeconomic impacts.

- In QCE Economics (Queensland), the focus includes Australia’s economic objectives and how monetary policy helps achieve them.

- In BSSS Economics (ACT), students examine how the RBA uses interest rate adjustments to achieve economic objectives like price stability and full employment.

- In SACE Economics (South Australia), monetary policy is explored as a key tool for influencing aggregate demand and managing inflation.

- In WACE Economics (Western Australia), the focus includes how interest rate movements are transmitted through the economy to influence consumption and investment.

- In IB Economics, both HL and SL students study central banks and how interest rates are used globally to steer economic performance.

If you're studying Economics in Year 12 or preparing for assessments, understanding interest rate changes and the RBA’s actions is more than academic—it's assessable.

If you’d like help mastering these topics, view my profile on Learnmate and get tailored support from an experienced Economics tutor.

Alternatively, browse our subject listings to find the right tutor for Economics, Business Studies, or Commerce to help you connect theory with real-world understanding.

Final Thoughts

The RBA’s interest rate decisions are about more than just numbers - they reflect a delicate balancing act between growth and stability. And while economists and politicians often debate the best course of action, one thing’s clear: these decisions ripple through every corner of the Australian economy. So next time you hear about a rate hike or cut, you’ll know exactly what’s at stake and why it matters.

If you found these tips helpful, I’d personally love to support you as your tutor this year. You can view my profile here on Learnmate and contact me to discuss tutoring.

Alternatively, you can also engage other Economics tutors on Learnmate to help you refine your extended response skills, boost your confidence, and receive tailored guidance to ace your WACE Economics exams.

Glossary of terms

| Term | Definition |

|---|---|

| Cash rate | The interest rate set by the RBA for overnight loans between banks. It influences all other interest rates in the economy. |

| Inflation | The general increase in prices over time. A small amount of inflation is healthy, but too much can erode purchasing power. |

| Monetary policy | The actions taken by the RBA (mainly interest rate changes) to influence the economy’s performance. |

| Global Financial Crisis (GFC) | A major worldwide economic downturn that began in 2008, triggered by the collapse of financial institutions in the US. |

| Economic stimulus | Government or central bank actions (like interest rate cuts) designed to boost economic activity during slowdowns. |

| Overheating | When the economy grows too quickly, leading to inflation and unsustainable bubbles. |

| Tightening cycle | A series of interest rate increases used to cool the economy and control inflation. |

| HECS/HELP | Australia’s student loan system, which adjusts repayments based on income and inflation. |