This guide aims to provide you with a strong understanding of the structure of the general ledger and the correct approach to recording transactions within it. By applying the skills and techniques outlined in this blog across a variety of transactions, you will develop an efficient, formulaic, and adaptable technique for comprehending and recording business transactions, which is critical skill in VCE Accounting.

You will be introduced to a set of highly generalisable skills and a framework for enriching your understand- ing of business transactions.

What is the Double-Entry Accounting System?

Hopefully by now you are familiar with the terms debit and credit. Recording transactions as a set of debit and credit entries is the mechanism through which the double-entry accounting system works.

The double-entry accounting system requires transactions to be recorded with a debit component and a credit component of equal value. For this to be achieved, transactions must therefore affect at least two line items (accounts).

This idea of duality - having a debit component and credit component that are equal in value - ensures that all transactions preserve the balance of the accounting equation. That is, when recorded under the double-entry accounting system, assets will remain equal to the sum of liabilities and owner’s equity.

The double-entry accounting system is the backbone of the VCE accounting course. Having a strong understanding of it is vital to your success in the subject. For more tips on how to succeed in VCE accounting, see my previous blog post How to Succeed in VCE Accounting - Five Tips from a Professional Tutor and Past Accounting.

Ledgers: Structure and Use

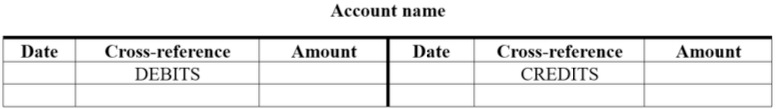

A ledger account, or a t-ledger, is a table in which transactions impacting a corresponding line item (or account) are recorded.

There is one ledger table for each line item in the business’ financial records. Ledgers consist of two sets of three columns: a date column, a cross-reference column and an amount column.

There are two sets of these three columns to reflect the fact that line items (accounts) can either be debited or credited in any given transaction.

If a line item is debited, then the transaction is to be recorded on the left side of the ledger. If a line item is credited, then the transaction should be recorded on the right side of the ledger.

What to Include in Each Column

For each ledger entry, you must fill out the date, cross-reference and amount columns on the correct side of the ledger (debit => left side, credit => right side). In the date column, enter the date of the corresponding transaction. In the amount column, you should write the dollar value of the effect of the transaction on the line item in whose ledger you is recording. The cross-reference column is most easily misunderstood.

As we record in a double-entry accounting framework, transactions have debit and credit components. These reflect individual line items that are increasing or decreasing in the transaction. If you are recording a debit (on the left side of the ledger), then you should write the name of the credit accounts in the cross-reference column. This is where understanding the complete effect of the transaction on each line item is crucial. Consider the following example:

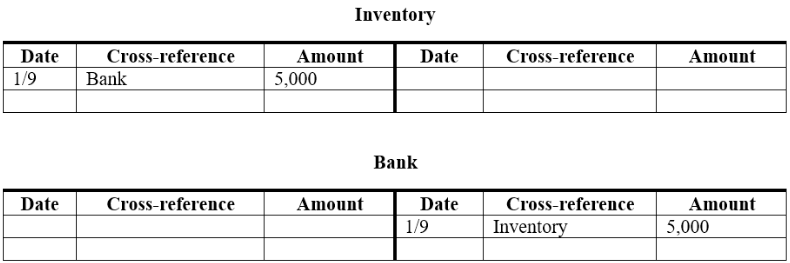

| 1-September Purchased $5,000 worth of inventory

This transaction increases inventory by $5,000 and decreases bank balance by $5,000. Since both inventory and bank are current assets:

Here's the correct ledger recording for this transaction: |

Notice that in each ledger entry, the cross-reference is the name of the account affected on the opposite side of the transaction: the cross-reference for the debit in inventory is the credit account - bank, while the cross-reference for the credit in bank is the debit account - inventory.

Let's explore another transaction.

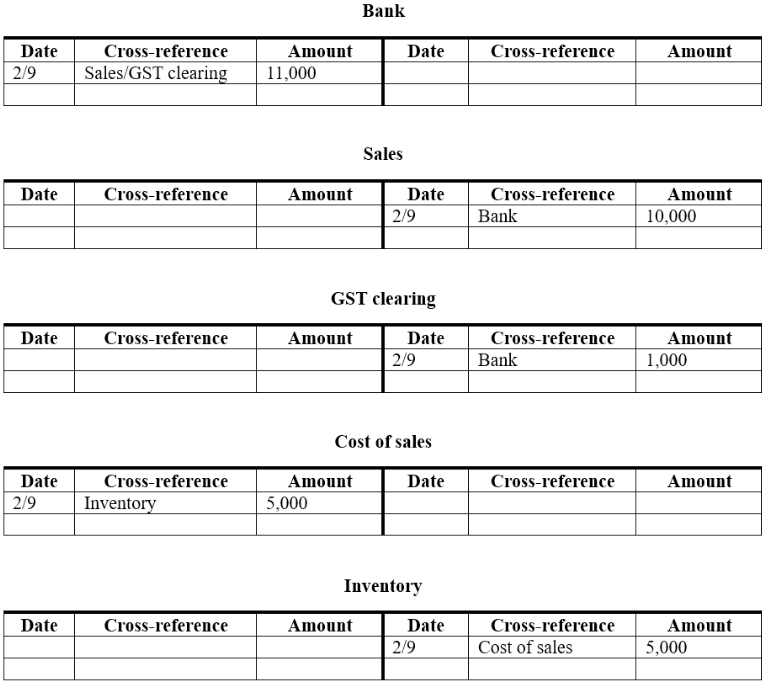

| 2-September Sold $5,000 worth of inventory plus GST

Being a cash sale, this transaction should be thought about in two parts: the sales component and the cost component. The sales component of the transaction involves a $11,000 increase in bank, a $10,000 increase in sales and a $1,000 increase in GST clearing. From the cost standpoint, the transaction increases cost of sales by $5,000 and decreases inventory by $5,000. Therefore: (Sales component)

(Cost component)

Notice that the sum of debits (11,000 +5,000 = 16,000) equals the sum of credits (10,000 + 1,000 + 5,000 = 16,000) Here's how this transaction should appear in the general ledger:

|

Notice that the cross-references state the names of the accounts on the opposite side of the transaction. Notice also that the accounts referenced are within the same component. That is, cross-references for entries in the sales component involve other accounts within the sales component, while cross-references for entries in the cost component involve other accounts in the cost component.

Conclusion

In VCE Accounting, we learn about business transactions from the standpoint of the double-entry accounting system. This requires students to be able to record transactions in a general ledger - a fundamental skill in VCE Accounting which you can expect to be first introduced to in unit 3. In this blog, we defined the double-entry accounting system and demonstrated a highly efficient technique for recording transactions in the general ledger.

Keep practising this essential skill with a variety of challenging transactions. You will be using it throughout the entire course!

Ready to Elevate Your VCE Accounting game this year? Connect with Expert VCE Accounting Tutors at Learnmate to enhance your understanding and confidence in tackling theory questions. Share this guide with your peers and together, step forward on your path to VCE Accounting success. Feel free to leverage other free resources on Learnmate or dive into other insights, tips, tricks and strategies by heading to our blog.

This blog was written by Ari A, a highly sought after VCE Accounting and VCE Maths Methods tutor on Learnmate. Ari achieved an ATAR of 99.10 and is currently studying a Bachelor of Commerce and Diploma in Mathematical Sciences. He is a highly experienced tutor who has been helping VCE students achieve their potential since graduating.

You can view Ari's profile, including his rave reviews and, subject to his availability, request Ari as your tutor here.